Project Type

Company Name

Related Industry

Description

1.Problem Statement

In the Property & Casualty (P&C) insurance industry, sales teams, MGAs (Managing General Agents), and wholesalers often struggle with the complexity of navigating multiple insurance carriers and integrating various third-party data services.

Key challenges included:

Fragmented Integration: Connecting separately to each carrier and third-party service (Google API, Core Logic, Zillow, Verisk, VIN services, etc.) created significant operational overhead.

Inefficient Sales Processes: Manual re-entry of data across different carrier systems led to slower quote generation, higher error rates, and reduced sales efficiency.

Legacy Systems: Outdated platforms lacked comprehensive data capture and transparency, hindering real-time decision-making.

Delayed Market Entry: Integrating with new carriers or updating rating engines required extensive development time, delaying market responsiveness.

Higher Operational Costs: Maintaining multiple integrations and managing different rating versions consumed valuable IT and operational resources.

2.Solution Provided

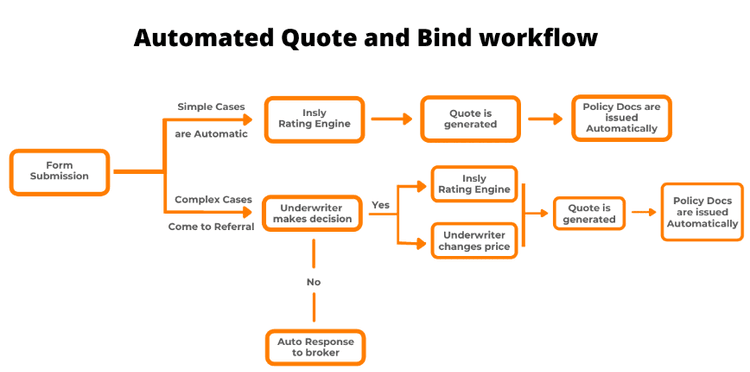

We delivered a Turn-Key Comparative Rating Digital Platform, designed to modernize and streamline the Rate, Quote & Bind processes for the P&C insurance market. The platform included:

Key Features:

- Single-Entry, Multi-Carrier Integration: Users input data once and receive real-time comparative indications from over 30 P&C insurance carriers.

- Comprehensive Third-Party Integration: Out-of-the-box support for services like Google API, Core Logic, E2Value, Zillow, Verisk, Distance To Coast (DTC), VIN services, and Address Cloud.

- API and Netrate Support: Easy integration with carrier systems and third-party data providers without extensive custom coding.

- Real-Time Comparative Rating: Instantaneous quote generation, reducing the need for manual re-entry across platforms.

- Seamless Core System Integration: Smooth connectivity with existing IMS (Insurance Management Systems) and other operational systems.

- Version Control for Rates: Maintenance of rating versions and seamless transition across carrier rate updates.

3.Business Impact

Comprehensive Data Capture and Transparency: The modernized Rate, Quote & Bind Platform ensures comprehensive data capture and transparency throughout the process, overcoming challenges posed by outdated legacy systems. This leads to better-informed decision-making and improved efficiency.

Seamless Integration: The platform seamlessly integrates with IMS and other core systems without requiring additional coding, reducing the time and resources needed for integration and ensuring smooth operations.

Streamlined Operations: By maintaining rating versions and facilitating smooth transitions across multiple rate updates, the platform streamlines operations for carriers and MGAs, leading to increased productivity and cost savings.

Real-time Comparative Rate, Quote & Bind: For MGAs and wholesalers, the Single-Entry Multi-Carrier Comparative Rate, Quote & Bind Digital Platform allows users to enter data once and receive comparative indications from multiple carriers in real-time. This eliminates the need for re-keying submissions and speeds up the process of obtaining quotes and binding policies.

Turn-key Comparative Rating Digital Platform: The turn-key comparative rating digital platform simplifies market entry by integrating with over 30 P&C insurance carriers and supporting API, Netrate, and various third-party integrations. This reduces the complexity and time required for navigating multiple carriers and third-party services, ultimately boosting sales efficiency.

Overall, these benefits highlight how modernizing rate, quote, and bind processes can lead to increased efficiency, reduced complexity, and improved competitiveness in the insurance industry.